SPREADPROFESSOR-TM

Technical Education Consulting Services for Professional Trader Development

contact: pete@spreadprofessor.com

Full Package: $7500 USD. All proprietary studies and files; over 100 hours of recorded webinars. 12 months of personal one-on-one consulting mentorship mutually arranged through "Go to Meeting". *

"Light" Package: $4500 USD. Includes all of the studies, files, and recorded webinars as given in the Full Package. Personal one-on-one consulting mentorship restricted to 15 hours total mutually arranged through "Go to Meeting" over a 12 month term. Highly technical or lengthy email responses count towards the 15 hour consultant time limitation. *

* 1. Client references available and encouraged, 2. IP NDA/Consultant-Client Terms and Conditions Contract Required, 3. Credit Cards accepted with prevailing card processing merchant fees added, 4. The "Light" Package is only available to new clients signed from January 2018 and later. Previous clients have a "Full Package" Terms Contract in force.

January, 2020 Email from a new Client for the "Light" contract package: "I received the materials today and I have to say, this is quite impressive content. It's an enormous amount of files, too."

December, 2017 Email from a Client who started paper trading the system in October of 2017. Keep in mind that at the time of this email this client is very green and the paper trading performance metrics almost always improve substantially over time. From WBB: "I've been reviewing all my winning trades and all the losing trades. The result, particularly with the losing trades, is kind of funny and encouraging... Looking through the losing trades... very few regrets. Yes, in a couple instances my stop was just a hair too tight. I'll fix that going forward. The vast majority of the losses were 'signal flips', meaning the hit to the bottom line was small. My average loser was only -$562 while the average winner was +$1,237. I'd like to get the win/loss ratio up into the low 60's from the mid-50's. That ratio is currently only 54%. But it's tough to have a lot of regrets with a P & L that shapes up like this. With 26 closed out trades, the net is +$11,887." (Note: three months on a simulated $50K account) "Plus, I have 5 paper trades still open and all 5 of them are in the black."

My preference for clients is a price-based mechanical entry system (three confirming functions) with a rules-based position management procedure established at time of trade entry. There are literally thousands of inter and intra market spread combinations that can be modeled, so there are plenty of opportunities. Furthermore, the overnight margin costs for spread positions are amongst the cheapest futures leverage available through the use of SPAN margin credits. I recommend that clients swing trade spreads and use the exchange-supported spreads whenever available for safety and slippage considerations.

Trade holding timeframes are entirely dependent upon the specific

spread's OTR average trading range and volatility. For example, you might hold

on to a Eurodollar butterfly spread for four months ( moves about 2 tics a

day ), and for an RBOB vs CL spread or a Gold vs Silver spread ( both very

high vol spreads ) your holding timeframe might be a couple days.

Personally, my preference is to lever less volatile spreads - but each

client has his own risk tolerance profile. We are modeling markets using

longer timeframes and we are swing trading. This is not designed to be a

high speed day trading endeavor. Spreads are cheap to margin overnight and carry - and the idea is to not enrich your broker and the exchange. I encourage my clients NOT to day trade. It is not unusual for a client to hold several

different spread positions working in several different markets

simultaneously - in fact, that's the idea if the trades present themselves.

We model hundreds if not thousands ( depends on the motivation of the client ) of different spread combinations in just about every electronic market available. I stress to my clients to be selective and to use that large pool of trading

opportunities to good advantage. Forcing trades is never a good idea, and

often-times that can't be helped if you are day trading or scalping a

singular market.

When we enter a trade, we set the profit target and the stop-loss level,

and it would be a good generalization to say that at that point in time the Risk/Reward is typically 1:1. Never worse, sometimes much better. But usually 1:1. The important caveat here, however, is that as the trade unfolds over time and works in the market, we find that for a significant percentage of our losses our indicator package takes us out of losers before the stop-loss level originally set at trade entry is reached. In other words, if the original conditions for taking the trade are no longer valid - you're out even if you have not hit the stop trigger.

Each client tracks his performance metrics, including drawdowns, during

the paper trading and peer review process ( weekly group webinars ) of the

training. Additionally, I encourage clients to schedule individual webinars with me in order to review their paper trading performance and ways to improve their trade selections.

Spread combination construction and the selection of products and expiries is a really big deal - I would rate it as more important than the indicator package in terms of good trade selection. I spend about 50% of my time during client webinars reviewing the different aspects of spread combination construction.

When you contract with me, you are buying my IP for your personal use

only. The terms and conditions and security of that IP is clearly spelled

out in the contract. In addition to providing the programmed .efs files for

eSignal, I provide the coding for the indicator package so that you can

adapt it to a number of charting packages that can chart synthetic and

exchange-supported spread expressions. I have several clients who have

adapted the indicator package to CQG ( easy ) and to Bloomberg ( harder, but

doable ). You've purchased the indicator package for your own use with the

fee, and there are no additional costs to use it.

Finally, over the course of several years from my observations I find a direct correlation between the effort and time the client takes during the spread construction and paper trading phase of the program to have a strong correlation to his relative success using the strategy for himself in the live markets.

If someone hires a mentor or educator and just expects to be gifted with an ATM with very little effort on his part - then again that person will never succeed. If that sounds like you, please don't waste your money and my time. The secret is that there is no secret. No holy grail. Every successful trader works his ass off at it. And if someone requires certainty - go get a government job because trading is definitely not your line of work. Absolutely no one can predict what markets are going to do in the future. But some trading systems are much better than others, and one of the key mistakes I see from clients during our initial time together is that in their previous trading endeavors they spent all of their time concocting a magical trade entry, but position management is a case-by-case afterthought.

Over the past few years in particular, we have accumulated a number of both individual and group webinar recordings where we review live and paper trade set-ups, clients review their performance metrics, and we construct spread combinations and talk about many topics like correlation analysis and execution. I also record special instructional webinars on a solo basis where I present specific topics, concepts and materials.

So, there is a much larger body of work that the new client receives in terms of background materials and instruction than there was just a couple years ago.

As of January 2018, it typically takes a new client anywhere from 2 to 4 weeks just to initially review the new materials. At that point, the client will take the proprietary indicator package and the spread combination build-out spreadsheets ( typically using eSignal ) and will then proceed to construct his own chart modeling platform. After several weeks, a client might have several hundred spread combinations in all worldwide electronic futures markets. The client then begins a phase of paper or SIM trading under my review and tracks his performance metrics ( especially drawdowns and W/L ratios ).

Regarding the Advantage Futures Year-End Trading Statement Post further down in this website page; a posting from Baron Robertson, ET Founder and posted on the Elite Trader website:

"I received a response from a third party regarding the disputed statement so I am sharing it here. I'm not reopening this thread for further responses, but will continue to post opinions from emails sent to me by other third parties should they arrive.

Hello Baron,

My name is Patrick Agate. I am The risk manager and active partner with Prime International Trading. I have been the Risk manager since 2003 and active partner since 2011. We are a proprietary trading firm that mainly trades options on commodity futures. We also have several off floor spread traders within our firm.

All of our traders our independent contractors and they get paid a percentage of their profits earned at different intervals throughout the year based on the terms of their contract.

I am giving you some background on myself just to let you know that I am very clear on how prop deals work and I know how to read statements from clearing firms.

The statement in question is from advantage futures who my firm has used in the past to clear trades. Currently most of our business is cleared through Rosenthall Collins Group and New Edge. My point is that the clearing statements are all very similar and I deal with them on a daily basis.

On this statement from Advantage futures I see the beginning balance of 488,204.63 (US non reg) and then see the cash was swept out 486,124.63 on 1/2/7 for profits in 06.

It is pretty clear this account made some good money... If you have any further questions please let me know.

Pat Agate

Prime International Trading"

Regarding my integrity and value for clients as posted on the Elite Trader website:

From Baron Robertson, ET Founder:

"For 17 years, this site has always been ultra-critical of education providers, and rightly so. From my experience, most of them simply don't have what it takes to back up their claims of past performance and potential profitability. But I said most, not all. Although he has taken tons of heat over the years from a variety of different angles, I think bone has repeatedly demonstrated a level head by answering questions, providing statements and references, and generally being one of the rare education providers who actually tries to work through the criticism first instead of just complaining about it to me immediately.

I would also like to state for the record that bone has been a sponsor here for many years. And in that time, I've never had a single client of his contact me with one negative comment about him or his services. So although everybody may have different opinions about aspects of his education business, I think he's a big asset here at ET and has established a solid track record, especially given the extreme scrutiny he's faced."

Client Comments posted on the Elite Trader website from 09/19/2014:

RockMachine:

At the risk of voiding my contract with Bone, I wanted to give an unbiased opinion of Spreadprofessor's service.

1. The price is high = yes. However, as stated Bone ONLY wants experienced traders. Well, experienced traders are MUCH harder to train because you have to un-train them first. New clients after a few weeks/months are encouraged to post their trade setups. Often, they show head and shoulder and archaic setups with multiple squiggly lines, etc. Myself, I had a nasty habit of placing tight stops, which every few months I revert to. Point is, Bone didn't teach this stuff.

2. The Guy really cares = Hell Yes! I'm on my 10th month of a 6month contract. Why? because I'm not ready.

But to be clear, I contribute and I want it!

3. The $500k trade issue = Don't know. Semantics wise, if I were to make x$ in say the "Crack spread" for 2013, I would phrase it " I made X$ trading the Crack Spread last year. "

4. Is this the Turtle Experiment = Kinda. Richard Dennis said that he could publish his strategy in print and MOST people would lose money. In fact his original group has some who prospered and others who crashed.

Weakest link is always the trader.

5. Overall, Bone's experience and knowledge of spread trading in 2014 is easily top 10,5,3 in the world. However, if you trade automated by ticks and turnover 100's of trades per day, then you will need to be un-trained, unless of course your infrastructure budget can compete with the big boys.

6. Finally, I have met and worked with a few people on ET, some were good, others would eat their children for $500..YOU KNOW who you are.. As for Bone, he's legit and cares and is very cautious as to working with the right people and especially before he lets you trade live.

Eudamonia:

As a current client I made my decision regarding Bone's services based on discussions with his references (former clients). Were they able to apply what Bone taught them and derive an edge? And the answer to that was yes - although it would require a lot of work on my part to learn the system (hence why it is a 6+ month contract).

Currently, after four months of simulated trading I'm sitting on a 70% win ratio with a 1:1 reward to risk. Several other traders have shown their results in our trading room of their own trading that is similar or in some cases better. After a few more months I will switch over to live and anticipate I'll see similar results in a live account (because I have accounted for commissions and slippage in my estimates).

I don't believe that my $7,500 has been anything but an excellent investment and highly recommend Bone's services.

R1234:

I signed up with spread professor last year. When I first signed up I must admit I was a bit concerned it might be a waste of money or maybe even a scam. But as I began adding his method to my existing methods I can say it does add value and I have more than made back my investment. His method is legit if used consistently and does carry an edge.

J-Law:

For all the naysayers & harsh critics of Bone & his spreadprofessor services....not only are his offers legitimate & sound. His ethics compass is intact & oriented in the right direction. If you are on the fence about working with him, just know that he has his feet on the ground & you will walk away from the experience with a greater knowledge of futures, spreading & tradecraft in general.

From a prospective client in Australia with his observation about the successful traders at his proprietary trading firm: "Reason I'm interested in spreads as I noticed the biggest earners and generally least stressed traders were the spreaders, and the secrets to this art form were very closely held."

Client feedback via email from March, 2014:

""I did however apply your methods in my live account for trading on NSE, India in last month and had 2 profitable spread trades on equities and indices and I could hold them for 2-3 weeks which I have found difficult with outright contracts."

"With regard to my results with his methods, over 65% trades were closed in profits over last 8 months and I feel confident using the method adopted in his course. I could feel the difference between holding an outright contract and holding a spread trade for days to weeks. With spreads, I was more comfortable holding overnight as I am relatively immune to broader market movements and sudden geopolitical events. Overall, I am satisfied with my spread trade results."

New Client Emailed Initial Impressions on the Materials Received from the Consultant on Day One:

"It took me two weeks to watch the historical recorded webinars alone. Seriously. Two weeks."

"I started watching the webinars over the weekend, and downloaded the proprietary study indicators into eSignal. I am overwhelmed at the massive number of spread combinations"

" Holy Shit. It took me the entire weekend and half my hard drive to download all this stuff - where the hell do I start ?"

Now providing proprietary charting studies and indicator package to clients designed specifically for Spread Trading

Please Note: there is a rules set of specific conditions that is required to be met before a trade entry can be taken. The provided proprietary charting package is useless without proper adherence to the rules set. The rules set is explained in great detail with literally hundreds of actual market examples in the recorded webinars. The entire process of spread combination construction and modeling is also covered in the webinars. The trade selection and risk management process of setting profit targets, stop-loss levels, and entry price ranges is also covered in great detail in the webinars.

SpreadProfessor Live Market Training Progression

SpreadProfessor is acting as a training Consultant to the Client and is not making any offers or recommendations to buy or sell securities to, on behalf of, or for the Client. There is no legitimate way that SpreadProfessor can make any representations in terms of Client performance expectations. The client's capitalization bankroll is entirely dependent on the client - I have independent clients clearing IB with $20K and I have independent clients clearing New Edge which requires a minimum $3M initial account balance. I have European prop clients clearing Schneider and I have Australian prop clients with Silk Road clearing MF... I have CTAs and hedge fund clients; it's just all over the map. So, it isn’t easy recommending capitalization levels.

Time-to-Live Trade is also entirely dependent on the client. I still trade quite a bit personally, so I keep a controlled number of clients and I rotate them through the program at fixed intervals. They all start out training with me personally on a one-to-one basis with the modeling tools and the trading system procedures. For the first few training sessions the consultant introduces the client to the trading models, the spread position construction combinations, and helps the client set up his own personal trading station in order to run the models. Once a certain competency threshold is met the client starts paper trading with the consultant. During the paper trading process with me they are getting very consistent feedback from me with respect to the model trading signals, trade signal confirmation, the profit targets, and the stop/loss levels. At that stage in the training, I will also start to teach them how to construct their own spread combinations and make modeling adjustments.

Let me explain the term "paper trading" as it relates to me and my clients at least - as soon as they get a trading signal on their own personal trading stations at their office or home they provide me with a few model specifics, the market, the price level, and their profit and stop/loss levels via email. In that way I'm able to give them feedback, and the email notification gets tracked and trended by me. Once they close out the trade, they also notify me. So, in terms of the training and feedback process for the model and the trading system there is definite accountability and a progression to things. During the course of this "paper trading" phase, there is a great deal of email interaction between the client and consultant about trading signal validity, holding timeframes, and valid stop/loss and profit target levels for the trade.

Time-to-Live Trade can be somewhat abbreviated with experienced professional traders; for example, I took on a Chicago CTA as a client in late June of 2010, and he started trading live the first week in September of 2010.

For example, during August 2010, 3 clients who started in June 2010 had the following Win-Loss records paper trading with me:

DS: 39W, 11L, 9S

CL: 41W, 32L

MH: 16W, 7L, 1S

So, everything is pretty much client-dependent in terms of capitalization and to some extent Time-to-Live-Market trading time horizons. Generally speaking, I like to see my clients in the 58-65% Win-Loss ratio percentages in terms of their own paper or SIM trading before I would recommend to them that they're ready to open their own account and make their own choices about risking capital in the live marketplace.

Where's the Value In It?

Going It Alone: reflect upon your background, experience, capital and time resources. That evaluation needs to include trading losses, expenses and the time value component required for development. Failure is also a very real possibility. How likely is it that you can sift through the internet, various seminars, academia, or texts and mine worthwhile information? Make sure that your personal assessment is realistic.

Experienced Traders: what is a fresh trading revenue stream and exposure to new market spaces and techniques worth? Are you forcing trades in your existing market, and would some proven diversity ease the pressure. Portfolio managers are constantly searching for alpha, and legitimate diversity in tactics and markets is a career-bending enhancement for independent traders.

In an isolated and secretive profession stocked with exceptionally intelligent and competitive people, can a well-regarded and talented advisor working with you on a personal and interactive basis help you take it to the next level?

Why do most hedge funds and bank desks engage heavily in spread trading and relative-value market making, while independent traders and retail-oriented speculators seem to prefer directional flat price risk?

Several existing clients have proven that even quite modest, retail-oriented accounts (Interactive Brokers being a great example) and commission structures are perfectly adequate to trade properly refined relative-value spread trading strategies. High Frequency trading is not required - or even desired.

SpreadProfessor has 20 consecutive years as a trader and private trading consultant to qualified professionals, so save yourself alot of time, expense, and abuse by using my expertise to your benefit. Skeptical? Good - my clients were shocked and subsequently pleased that I am building a business doing what few (if any) others will. E-Mail me, tell me about your background and trading goals, then review my credentials and independently ask my clients questions for yourself before you make a committment.

Important Note: Consultant is not a Commodity Trading Advisor or Securities Broker, and is not making any offers or recommendations to buy or sell any securities. Consultant makes no market or securities risk advisements of any type. Consultant makes no revenue on hardware, software, commissions, brokerage, or any other hidden fees. Consultant makes no performance claims, express or implied. Client performs due diligence on the Consultant, and both parties enter into a contractual agreement for the performance of technical analysis consulting services on securities markets before technical education work begins. A key element for any prospective client's due diligence process is to get an independent evaluation from current clients regarding the consultant's fitness, integrity, technical knowledge, and value. An example of the provided technical studies by the Consultant to the Client includes statistical studies like time series analysis for time and sales data as provided by regulated trading exchanges and disseminated in the public domain.

The CFTC urges you to be skeptical when promoters of trading systems and advisory services claim that their products and services will earn high profits with minimal risks. The CFTC advises you to consider the following:

- Whether or not a trading system is used, commodity futures and options are typically high-risk endeavors

- No trading system can guarantee profits

- Not all system promoters are required to be members of the National Futures Association or registered with the CFTC. Check their registration and disciplinary status with the CFTC and the NFA.

A number of my Clients are making money in these markets - just ask them for yourself! I teach pre-qualified professional traders a very detailed relative value correlation trading system. As part of the due diligence process, I ask each prospective client to contact some existing clients and inquire as to that client's personal experiences and opinions about their particular profit potential and value. I am happy to provide to potential clients, whom I pre-qualify, with former client contacts so that they can be independently contacted and queried about their experiences.

No subjective interpretation of chart patterns, wave counts, Gann lines or candlestick formations. My preference for clients is a price-based mechanical entry system (three confirming functions) with an established position management procedure.

Email me your questions! Serious prospects are invited to contact me for direct email instructions to current clients for your independent due diligence. I provide personal and professional background materials in addition to the client references.

Required Monthly Infrastructure Expenses: varies greatly - I have clients spending about $100 per month using eSignal; in terms of trade execution clients use TT or CTS and various FCM's in-house front end, including Interactive Brokers. Bottom line: highly scalable and portable strategy.

Reports from Current Independent Trader Clients:

Feedback from JR on 03-03-11 re: his initial experiences live trading, and the possibility of balancing his job with trading:

I didn’t send but I had 3 trades last week that netted 1,600. I only traded one day though. My absolute monster to work through is time – getting to a consistent routine, reviewing markets to identify entries and then being able to handle entry intraday. It’s that crazy simple though just a bear to work through. I’m really thinking about ditching the job ~August and trading fulltime to alleviate this issue.

Feedback from MH on 03-07-11 re: his second week of live trading:

By the way - I'm hanging in there - had a great day on monday - +$1800 (I forget how many trades I had). Today and yesterday were slow. Had a couple of losers (small) and just couldn't get a feel for things, so I hung back. ($500) between the two days.

Feedback from MH on 03-02-2011 re: his first day of live trading:

Anyway, I finally traded today for the first time. Had a great day. 6 trades, 5 winners. +$3,575 for the day. 5 trades in the gasoil crack spread, and one in gold/silver.

Feedback from BM on 02-15-10:

... last week was my first full week trading the spreads - net P&L was a gain just under $1K. ... pretty damn good spreading one-lot futures!

Feedback from PA on 02-06-10:

Pete, I had my best week so far! It started last Friday... just trading levels back and forth. Then as usual I was caught long the spread on the close, so I held it into the night session. Got hit on four fishing orders right on the open, putting my orders well off the market like we talked about at 7pm for a quick 1500 USD. Then came in Monday just looking to get out of the position at a better level. Next thing I know I am trading the position up and down selling highs and buying lows like a champ. It was great...it seems like I am really in sync with the moves now dynamically adjusting to levels. AND again just flashing orders in and out where I am looking to get hit instead of leaving stuff in and attracting attention.

... Ever since I started really applying your advice, I have had nothing but increased success.

... The correlations have been good, I still don't have the confidence to trade off of them, because its really more of an indication then a signal...as you see the divergence you start to think yes its going to "catch up"...and it does almost every time, however from the time I notice it and start to think its going to move...til when it actually does is awhile and I would have taken all sorts of heat.

So, in a nutshell...you have kept me really busy even though we have not talked in a bit...but that's a good thing right?

I still want to learn the other stuff. My increased success is going to give me the opportunity for them to let me do it.

My wife tells me I seem so much more happy and excited about life in general now...and its true!

For this I thank you Sir...

Feedback from LW on 02-09-10:

... to that end your help has really made a difference in my existing trading. ... previously I only traded when all factors were favourable, which meant doing only 10-12 trades/month. Now I am doing 30-40 trades/month, as my research showed that my expectancy was almost the same when there was at least one factor/reason to do a trade rather than several. ... I have also largely dropped the mean reversion trades after learning that you only like to follow the trend. It makes sense and I have noticed less 'sphincter-clenching' moments of getting caught in a blow out spread wondering what the hell happened.

Feedback from AJM on 11-17-09:

its a big change from the algo stuff or scalping 10's that i've been doing for the last several years but much better than...(what I was doing)... i really am likeing the energy stuff and have been very consistent on everything i'm trading except ed cal spreads. The goal is the same level of consistency with much larger size. I plan on exploring some of the equity spreads in the next month with the goal of automating 15 to 20 pairs although i am quite happy trading futures.

Feedback from JP (a new client with his first consultation on 11-09-09) on 11-17-09:

Things are definitely better, especially since I have more trades to look at. I am still getting used to the (system)...Overall, I have made money with the trades, now I just need to get use to maximizing the (system).

Feedback from Jason on 11-16-09:

Please add my name to your referral lists for future clients.

Feedback from Angelo on 11-13-09:

this is the kind of trade that I either want to cover now, or selling another 10...

Feedback from TH on 11-09-09:

That equity spread has some juice I have found 2 good trades a day of >10 points . Yesterday I grabbed 30 at a limit and she kept on motoring for a while reversed and you can have another . It tends to trade like that intra day Ie +10 -10 then it will continue in the direction of the daily trend . If you come in and just determine the divergence on the model on the open and fire away

Feedback from LW on 11-06-09:

Thanks for your thoughts today. Regarding position sizing...When I hit $10k risk per trade will re-assess, hopefully I can get to this level in under 6 months.

Feedback from Jason on 10-02-09:

Pete,

We may have found the cash machine with these ... spreads. Traded 1 lot to figure out how to use the cqg trader.... all winning trades. ... is smooothh. Dabbled in the energy (crack spread) for 4 ticks on 3 lot. I'm thinking 10 ticks might be a good target for this instruments; your thoughts?

Feedback from Alvin on 10-02-09:

Hey Pete,

Took 1 trade in the NG Fly and made ... Sold -547,-548 , Bought 552, 554.

Alvin

Feedback from AM on 9-20-09:

Pete-

The week that was:

9/14: -2.5 T Followed the model but try to ancitipate move down based 'xxyy'.

9/15 +6 T Followed the model ZZ and AA agreed.

9/16 -2.0 T If you remember this was the day we were both short at the ... looked over extended.

9/17 +5.0 T Just scaled down the previous short. I did add 3 more that morning around 151.00.

9/18 +3.0 T Took the buy off the XX. ZZ min also turned a buy.

Total for the week +9.0T in the EuroDollar.

Feedback from Luke on 09-18-09:

I started trading intraday equity index spreads this week. I am using your model ... I backtested your system over 6 months for 10 different XXX spread combos... I tested the forecasting accuracy of ... As far as I'm concerned this is a huge edge, and highlights to me... the effectiveness of your model. This has been a revelation to me, previously I tried doing... trades - no wonder I couldn't get an edge! ...So in summary, very positive so far, and looking forward to getting more trades under my belt in the next few weeks. (redacted per the client's request)

Feedback from Luke, on 09-10-09:

G'day Pete,

Just thought I'd update you on progress. I've traded a few sessions using your system with 4 winners from 5 trades, so off to a good start.

Feedback from Paul, on 09-04-09:

1st trade: got chopped a bit after the #, but my size was 2 lots.

2nd trade: sold 5 lots ********** spread on the way down at 134.5, just covered at 132.0So up a little today. Yee ha!

Feedback from Tristan, on 09-04-09:

ps by the way ROI on your services is around 400 % for the week actually make that 2 day's so post that to those ET d***heads .

E

En Trading Consulting Services through S&P’s Vista Research Division:

What the SpreadProfessor service provides to the client:

1. Instruction hours outside of normal U.S. market trading hours; typically in the afternoons and evenings. Instruction is both interpersonal (one-on-one) and in group formats, depending on the requirement circumstances and is at the discretion of the SpreadProfessor instructor. Many instruction sessions take place over the internet via live or previously recorded Webinars using the instructor's charting platform and statistical modeling tools. Most instructions, like statistical studies and modeling for spread instrument construction or trade execution and management takes place in group settings and individual one-on-one sessions over secure webinar. All group webinars and instructional materials will be archived and posted via a remote secure server. Clients also have access to the SpreadProfessor's personal email and cell phone. Because the instruction format is more group-based than individualized, the costs can be held to a much more reasonable level than an exclusive personal consulting retainer.

2. Clients are encouraged to review their trading performance with the SpreadProfessor either personally or with the other clients via secure webinar interaction. The SpreadProfessor will always respect the confidentiality requests for each subscriber wishing to keep spread combinations and studies private from other subscribers.

3. SpreadProfessor brings fresh ideas and concepts to the new subscriber's trading universe. Energy, interest rates, all sorts of commodities, OTC - you name it, and the SpreadProfessor has probably either traded it or extensively modeled it.

4. Consulting fee due in a lump sum payment, which can be made via wire transfer, cleared personal check, or credit card. The payment includes the secure distribution of proprietary files and studies, recorded webinars, and the ability to view the SpreadProfessor's online charts and modeling during webinars. Each client is responsible for his own individual personal charting and statistical study subscriptions. Important note: SpreadProfessor strongly advises that clients consult their tax professionals about the possibility of deducting the SpreadProfessor subscription cost as a professional service - this includes all subscribers itemizing deductions for Federal Returns on Forms W-2, 1256, and 1099.

5. Because of the high level of detail and professional competency associated with my trade and trader development work, I will not be allowing free trial periods.

6. SpreadProfessor clients are using eSignal (mostly) and CQG charting packages for the analytics with technical study component settings provided by SpreadProfessor. Other charting packages which support synthetic futures and exchange supported futures expressions might also be made to work with some additional effort. Spreadprofessor supplies the study coding in addition to a canned .efs eSignal file ready-to-go.

7. SpreadProfessor clients are a mix of proprietary and independent professional traders; some use the Trading Technologies or the CTS-4 platforms for execution, but there is an increasing trend for clients to use the broker-provided execution desk.

8. Clients use a number of different clearing firms - Interactive Brokers, Advantage, Crossland, RCG, RJO, etc.

10. SpreadProfessor does not execute trades for clients, does not recommend specific buys or sells, is not an introducing broker, and takes no commissions or subscription fees or haircuts of any kind from the client other than the initial consulting fee.

11. All clients are required to review, approve, and sign a four page consulting agreement contract. The contract addresses contract terms, intellectual property rights, defines the relationship between consultant and client, and details the risks the client is undertaking.

Some potential clients have asked about splitting trading profits in lieu of the subscription fee. My advice has typically been to use their existing capital to successfully complete the SpreadProfessor instruction, and then to start the interview process for a fully-backed proprietary trading position with a monthly draw salary.

I would invite you to email me with any questions you have, and to review the SpreadProfessor's credentials as a trader, his personal background information and the regulatory compliance information. Anyone seriously considering this service should weigh the value of their expectations against the value of the deliverable. My private email is strategery2@comcast.net

SpreadProfessor has no NFA, CFTC, or SEC sanctions. SpreadProfessor has no felony arrests or convictions. SpreadProfessor has no bankruptcy history or liens levied against him.

Specific and Factual Examples

Above is my 2006 annual statement from Advantage Futures. Over the course of 2006, $488,204.63 Profit was earned ( US non reg ) and then the cash was swept out as $486,124.63 on 01/02/07 for booked Profits for Year 2006 ( third party verified ** ). This account trading primarily the ICE Brent Crude/GasOil Crack Spread ( > 95% activity ), with some interest rate spreads as well. I was the only trader for this account number. I was part of a group that leased private office space and infrastructure from Advantage Futures in the CME building. Please note that this is an omnibus-type proprietary trading account with many sub-accounts that get zeroed out every year. But all of my personal trading activity was always related to this specific account during 2006 and this particular account was exclusive to me. The listed position was carried over the 2006/2007 holiday period and I typically traded considerably larger size when at the office during a typical trading day, and I almost always carried positions overnight. While I am not in any way implying that a client could replicate this performance, the fact of the matter is that I am an experienced spread trader in a number of different products. My references check out.

In my opinion, there is no reason why a good trader couldn't monitor and trade multiple spread combinations at the same time.

SpreadProfessor clients will learn how to properly construct and model spread combinations. Good correlation studies and proper instrument weighting are critical - that is the whole foundation for creating your own customized market to trade. Above is the statistical Z-Score plot for the Swiss Franc future versus the Eurex Bund future.

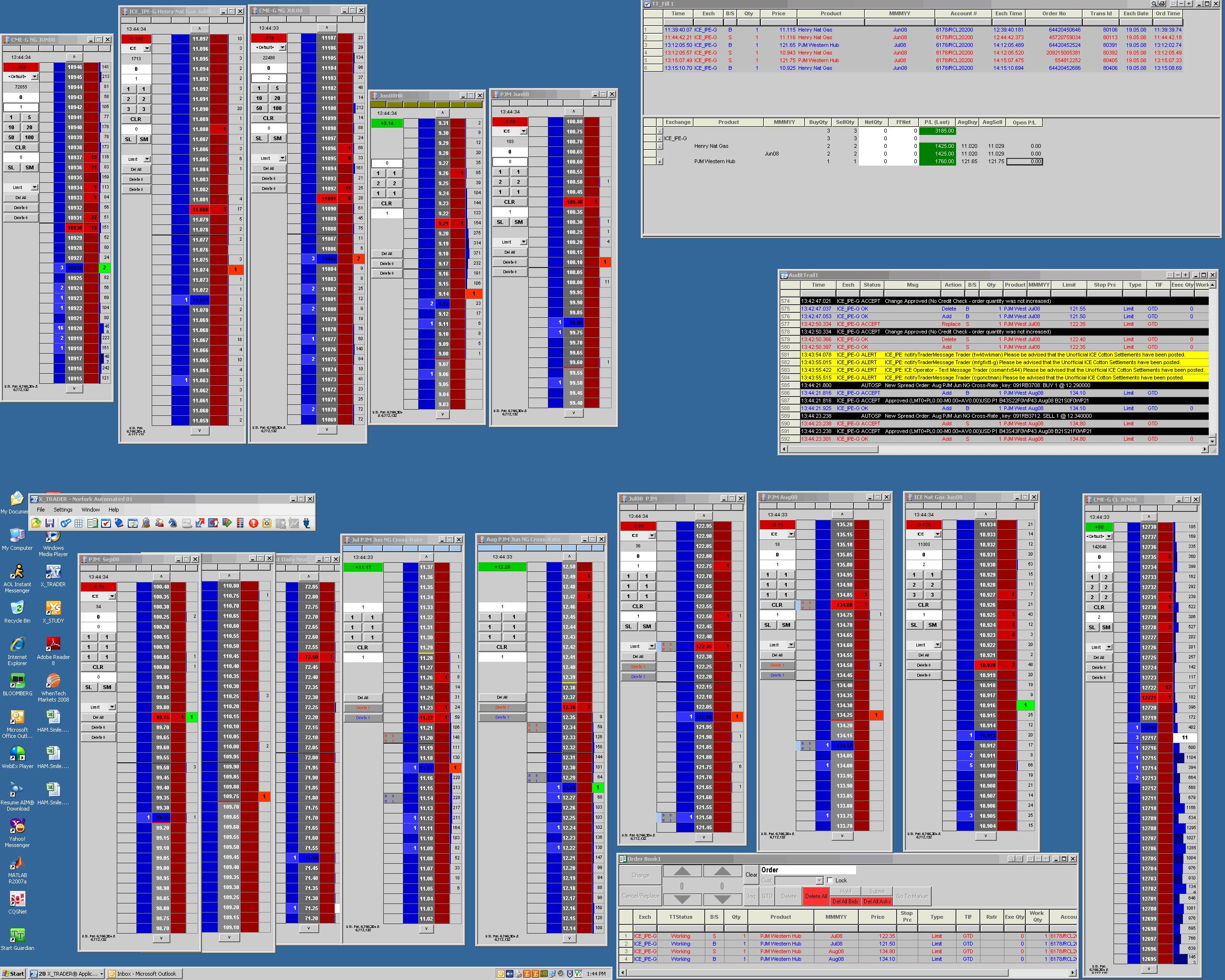

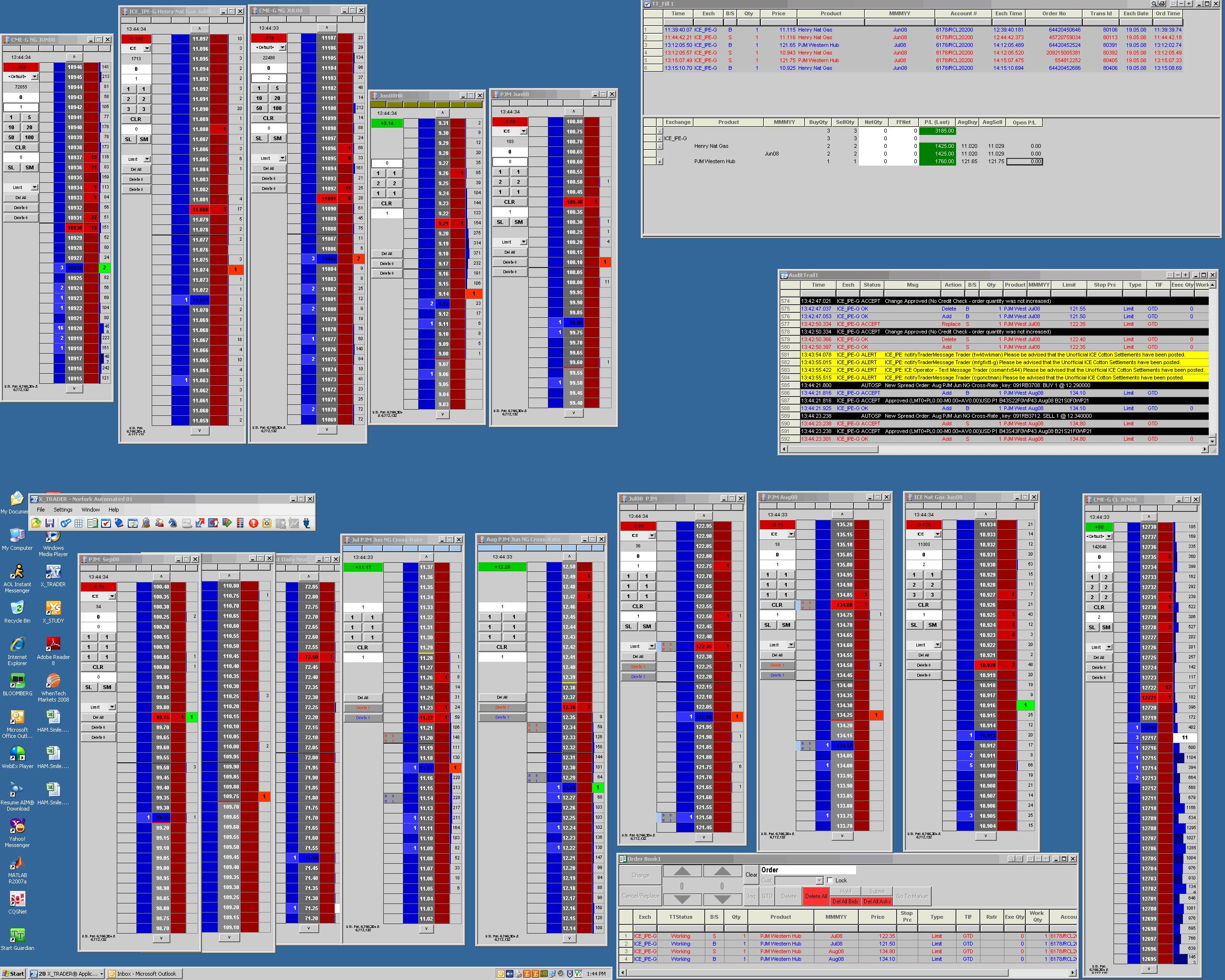

Above is my personal work station setup from the past using the Trading Technologies Auto Spreader for the PJM electricity versus natural gas heat rate spread OTC swap in 2007 and 2008. While you may or may not have access to Clearport or ICE-LCH products, I am once again demonstrating a breadth of knowledge and live experience resume.

Electronic screen execution settings for automated spreading tools need to be carefully refined and tuned to avoid getting 'picked off' or fined by an exchange for excessive messaging. This includes liquidity considerations such as market product quotation and execution slippage. Execution strategies are huge. Some traders are able to use their tradecraft skills to really improve spread leg price execution levels.

Some of the methods I train my clients in are spread trade combination construction and testing, execution, position management, and entry/exit signals.

What exactly is a spread trade?

A spread trade position includes two or more highly correlated instruments which requires the trader to be long (buy) one or more of the instruments and equally short (sell) the remaining instrument(s) which makes up the position. The object of the strategy is to profit from the price differentials from within the spread position and not from the direction or behavior of the broader market.

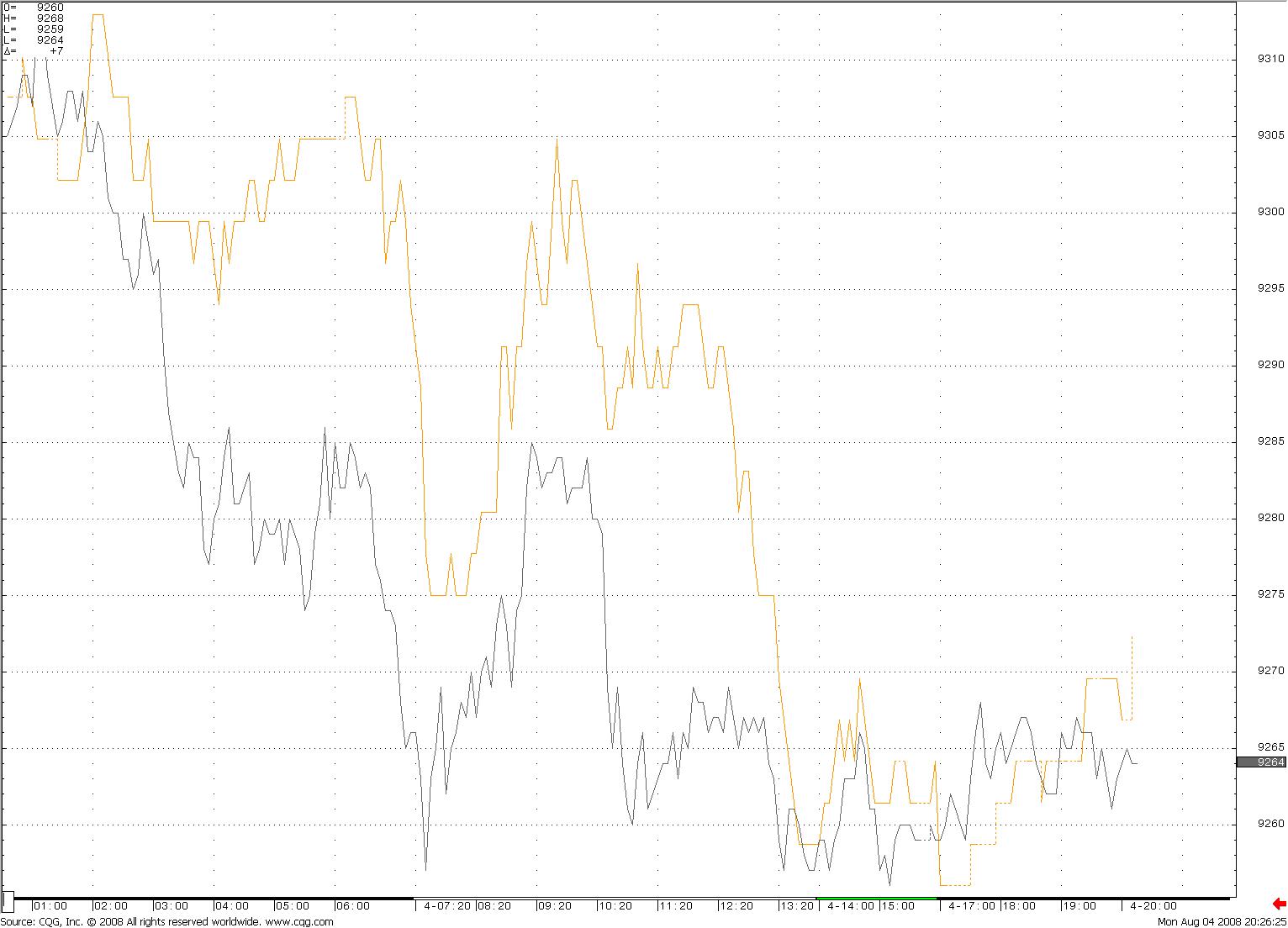

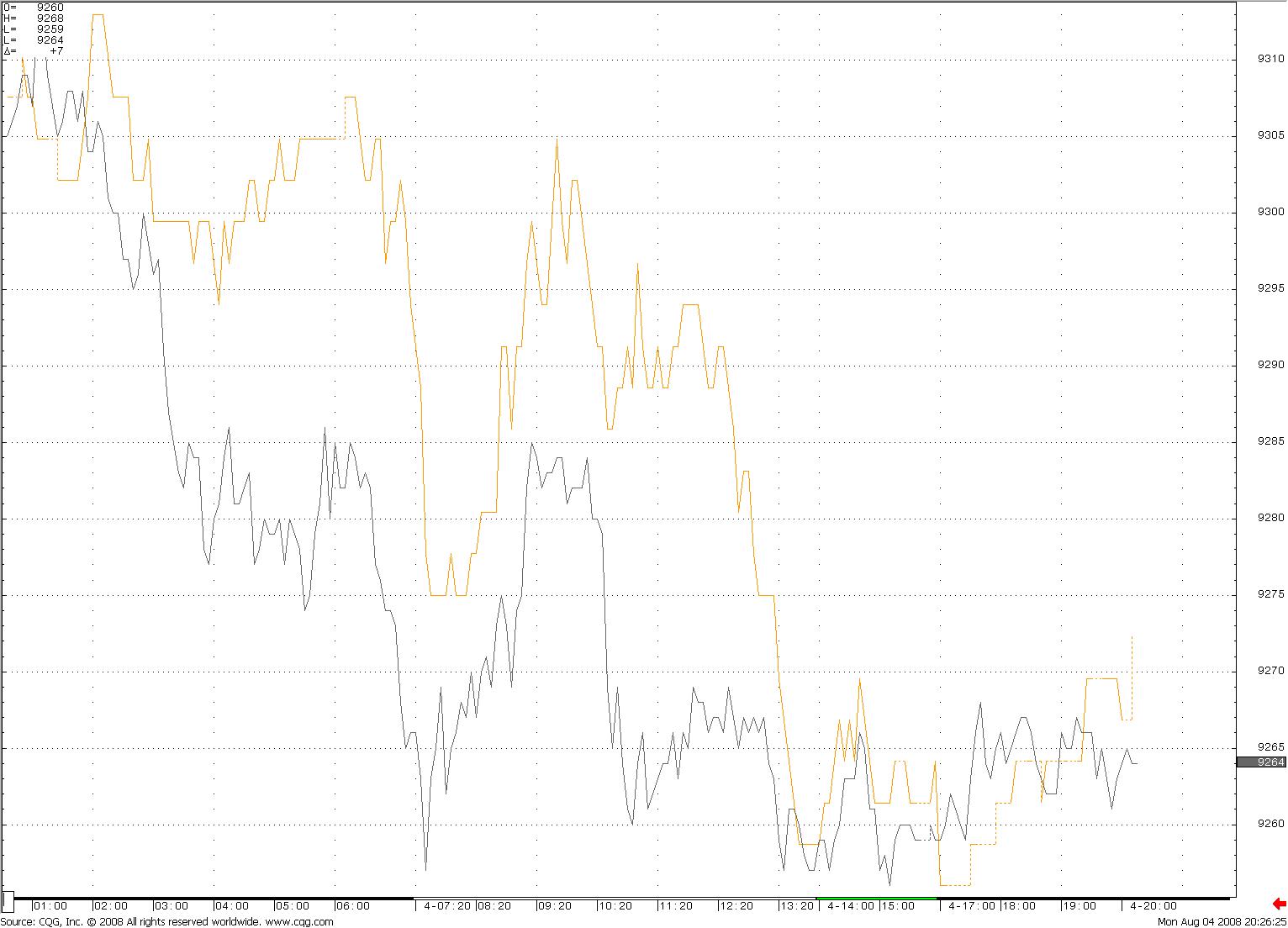

The chart above shows intraday price action for the August Nat Gas future (black) overlayed by the August/Sept/Oct Natural Gas Butterfly spread (blue) for June 26, 2009.

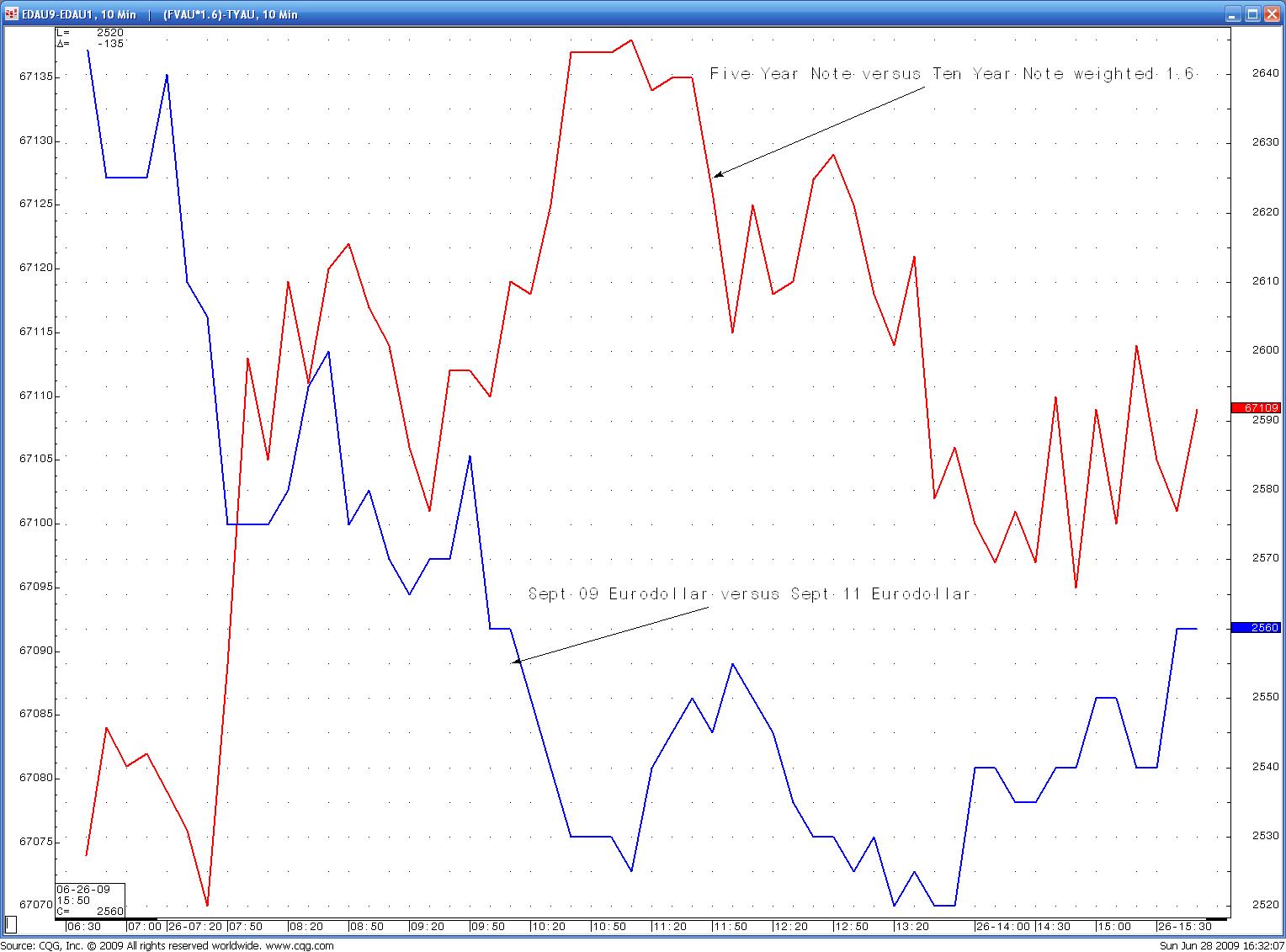

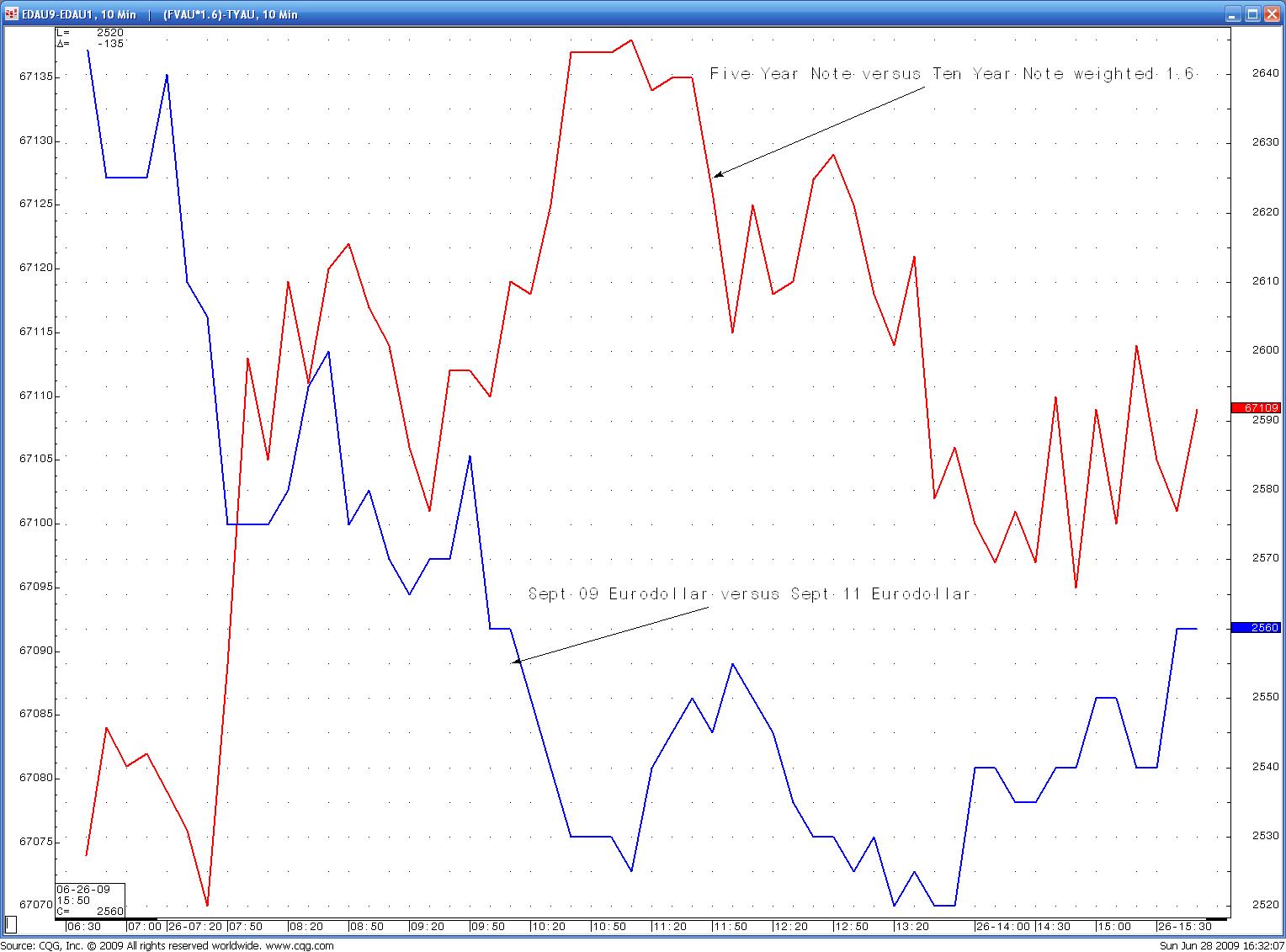

The blue line represents the Sept 09 Eurodollar versus the Sept 11 Eurodollar and the red line represents the Five Year Note versus the Ten Year Note weighted 1.6. This is intraday data for June 26, 2009.

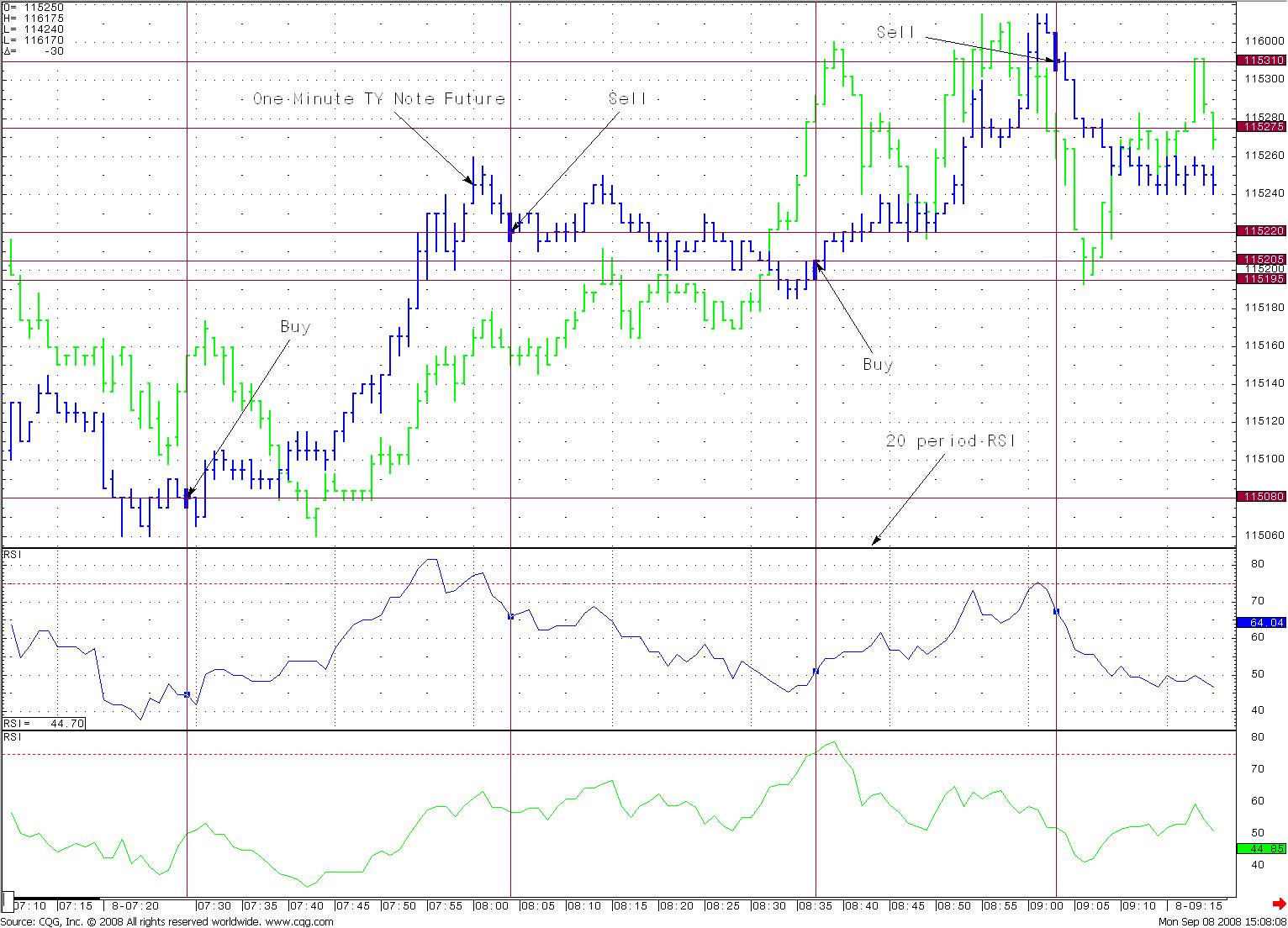

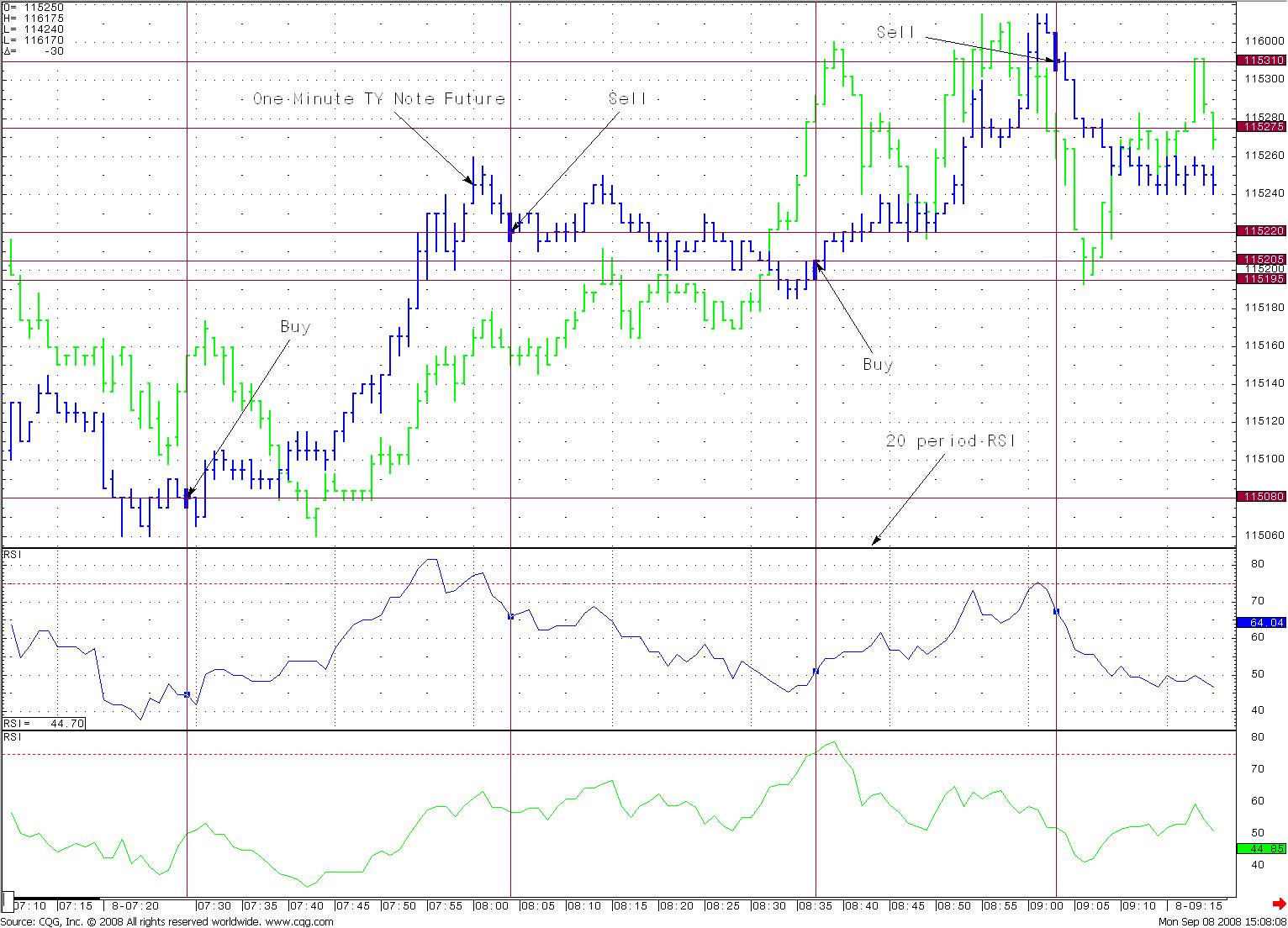

Here is the intraday data for the Ten Year Note future on June 26th, 2009 as shown above. Just a bit choppy.

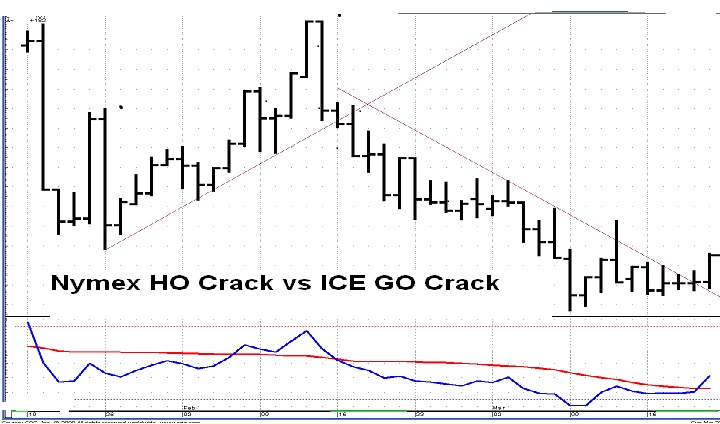

Shown above is the June 26, 2009 intraday data for the Nymex Heating Oil Crack Spread versus the ICE Gas/Oil Crack Spread.

Here is the June 26, 2009 intraday data for the August Nymex Crude Oil future.

In the electronic marketplace there is more opportunity now than ever before for spread traders to profit - especially for those who can show some creativity and are willing to learn. This unpresedented opportunity comes from the shear number of spreadable markets and products available to the electronic futures trader with a good FCM. The potential number of spread combinations numbers in the thousands. At least.

Worldwide, Hedge Funds and Bank Desks usually engage in spread trading for speculative purposes - relative value and stat arb are two of the most popular techniques. For that matter, any arbitrage trade is by definition a very highly correlated spread trade. Commercial desks that engage in dynamic hedging are managing the spread relationship between volatile commodity prices and their production requirements.

Charles DiFrancesca ("Charlie D") was considered by many to be the biggest and best Treasury Bond futures pit scalper on the old CBOT floor in his day. Among others, Charlie D counted the great technician Tom DeMark as a friend. One of Charlie's biggest weapons were the T-Bond's intraday correlations to various instruments. In his book entitled: Charlie D, author William Falloon quotes him as saying: "I may follow yen,... a commodities basket, oil, or the Dow... But I'm a spreader at heart...".

Any market on any exchange (and most OTC) can usually be tamed and made consistently profitable through the proper application of spread trading if the positions are constructed and modeled correctly. Electronic markets have greatly expanded the universe of opportunities for properly trained spread traders. For you personally to grow your success as a trader, consistency is the key. Consistent traders can month in and month out build trading account equity and grow their trading universe, pay the bills, maintain the mortgage, support families, have a 401K plan, and if they choose - a track record that attracts outside capitalization or professional employment interest.

The SpreadProfessor service provides a constantly expanding 'digital textbook' and reservoir of knowledge for the clients. Through the webinar process and shared screens, clients interact with me live and learn how to construct and trade spreads for their markets and time horizons of interest. Clients will know how to perform correlation analyses and technical studies for any spread combination they can think of. We will individually and collectively fine-tune and trouble-shoot trading ideas and set-ups and strategies during group webinars.

Terms and Conditions.

Consultant is acting as a training Consultant to the Client and is not making any offers or recommendations to buy or sell securities to, on behalf of, or for the Client. There is no legitimate way that SpreadProfessor can make any representations in terms of Client performance expectations. Client agrees to waive all legal recourse and legal rights against Consultant except as provided under Illinois Law. Clients fully and completely acknowledge that the buying and selling of any commodity, equity, stock, bond, or financial instrument results in the loss of that investment, and that the Consultant shall not to be held liable, responsible, or negligent in any way for the monetary, emotional injury, or any other injury resulting from any loss to the Client. The information the Consultant provides to the Client is deemed to be reliable, but is not guaranteed as to accuracy or completeness. Consultant recommends to Client that anyone trading financial markets should consult with a qualified financial advisor or professional investment counselor before doing so. All financial and securities markets are speculative, and contain a high degree of volatility and risk. Client agrees to maintain the confidentiality and security of the Consultant’s work. Client agrees not to reproduce, retransmit, sell, distribute, publish, broadcast, circulate or otherwise commercially exploit any information or content of the Consultant in any manner without the express written consent of the Consultant.

Past Performance is Not Indicative of Future Performance.

Historical, back-tested, hypothetical, and simulated performance results have inherent limitations. The Client acknowledges that past performance does not and should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance. The Consultant is not responsible for losses or damages arising out of errors, omissions or changes in market factors. The Consultant’s work does not purport to contain all of the information that an interested party may desire and, in fact, provides only a limited view of the securities and financial markets. The Client agrees that he is a sophisticated investor capable of understanding the considerable complexity and assuming the high degree of financial risk involved in all financial and securities markets.

Consultant is Active in the Financial and Securities Markets.

Client agrees that the Consultant buys and sells securities and financial instruments in the same markets that the Client is active in. Client agrees to waive all claims regarding conflicts of interest with the Consultant.

** available upon written request to qualified persons or regulators